Inflation falls to 7.9% in bigger than expected drop

The rate of price rises has dropped to 7.9% in the year up to June, according to the Office for National Statistics (ONS).

The consumer price index (CPI) measure of inflation shows prices are still rising, just at a slower pace than before, as the rate fell from 8.7% in the year to May.

Sponsored link

Recommended byWhat is Outbrain

Face Cream Deals In Lagos (Prices Might Surprise You)

Lagos: Smart Beds Clearance Sale: Prices In Mexico Might Surprise You

20 Things Ginger Does To The Body If Consumed Every Day

Discover the Top Engineering Degrees in the United States

20 High Blood Pressure Causing Foods To Avoid

Face Cream Deals In Lagos (Prices Might Surprise You)

Lagos: Smart Beds Clearance Sale: Prices In Mexico Might Surprise You

20 Things Ginger Does To The Body If Consumed Every Day

HealthyGem

Another measure of inflation, closely watched by the Bank of England when deciding whether to increase interest rates, also fell.

Analysis: Forecasts proven wrong - this time in a good way

Core inflation - the rate of price rises that excludes food and fuel - dropped to 6.9%. The rate had been increasing since January this year.

Most analysts now expect that the Bank will only increase the base interest rate to 5.25% early next month. Prior to the inflation announcement, an increase to 5.5% was seen as the most likely outcome.

Also changed since Wednesday morning's inflation data is the high the base interest rate might reach. It had been expected to top 6% but is now estimated to peak at 5.75%.

MORE ON COST OF LIVING

Supporters of Kenya's opposition leader Raila Odinga of the Azimio La Umoja (Declaration of Unity) One Kenya Alliance hurl stones as they confront with police during an anti-government protest against the imposition of tax hikes by the government in Nairobi, Kenya July 19, 2023. REUTERS/Monicah Mwangi

Kenya demonstrations: At least 12 injured as police clash with cost-of-living protesters

UK inflation: What has caused the surprise drop?

FILE PHOTO: A man shops inside a branch of a Tesco Extra Supermarket in London, Britain, February 10, 2022. Picture taken February 10, 2022. REUTERS/Paul Childs/File Photo

Supermarket deals drive down cost of grocery inflation for fourth month in a row

Related Topics:

Cost Of Living

Inflation

Interest Rates

Interest rates have been hiked 13 times in a row in an effort to dampen economic activity, take money out of the economy by increasing savings, and bring inflation down to 2%.

A higher rate set by the Bank means more expensive borrowing and higher mortgage bills.

Economists had thought core inflation would remain stuck at the same level as the month before - 7.1% - and that CPI would only fall to 8.2%.

But falling petrol and diesel costs, and a slowing down in food price rises, led to the surprise drop.

The rate of food inflation fell to 17.3% in June from 18.3% in May.

Also falling was the cost of raw materials - they dropped 2.7% in price - the first time they've actually become cheaper since late 2020, the ONS said.

The price of goods leaving factories grew 0.1%, down from a rise of 2.7%.

ANALYSIS: SOME GOOD NEWS BUT WORK TO DO

Gurpreet Narwan

Business correspondent

@gurpreetnarwan

Inflation has come down which is a good thing, and most importantly, it's coming down faster than we thought it might.

The inflation figure came in at 7.9%, that was better than expected. We thought it might come in at 8.2%, down from 8.7% the previous month but still almost four times more than the Bank of England's 2% target.

So, we've got some work to do.

The slowdown was driven by a slowdown in food prices, which we know have been rising at a staggering pace.

They rose by 18.3% the previous month.

Those big price increases are still rising, as I said at the fastest pace in decades, but they're coming down as are motor fuel prices.

Most importantly, something policymakers are looking at is core inflation, stripping away food, stripping away energy because they can be quite volatile, looking at underlying price pressures in the economy, something known as core inflation.

That came down from 7.1% to 6.9%.

Now all of this is good news because it takes pressure off the Bank of England to raise interest rates again next month.

We think it's going to have to raise rates because wage pressures are so robust in the economy.

And that's something that policymakers fear could spur inflation; they're going to want to nip that in the bud.

But financial markets have been pricing in a half percentage point increase to 5.5%.

This inflation data may take some of the pressure off and mean that policymakers only have to raise rates by a quarter of a percentage point.

Now, there's good news but it might not provide that much relief to anyone who's re-mortgaging in the next couple of months.

Prices have been rising since the later pandemic years as supply chain problems and difficulty sourcing goods pushed costs up. The war in Ukraine and ensuing energy crisis saw gas bills at record highs which pushed up costs across the economy.

As a result, inflation reached a high of 11.1% in October.

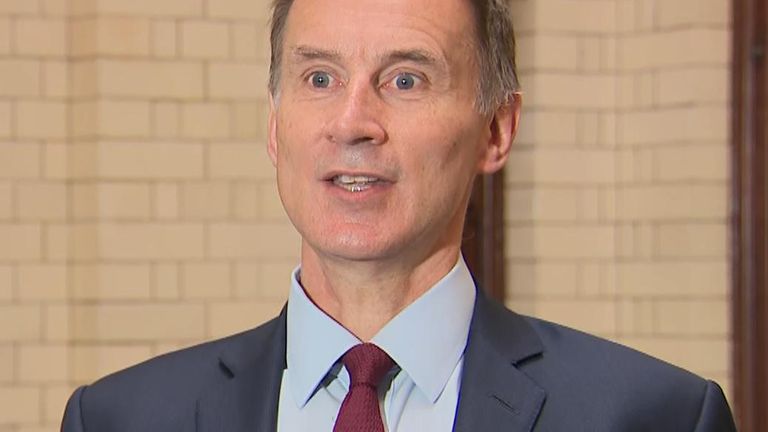

Chancellor Jeremy Hunt said: "Inflation is falling and stands at its lowest level since last March; but we aren't complacent and know that high prices are still a huge worry for families and businesses.

"The best and only way we can ease this pressure and get our economy growing again is by sticking to the plan to halve inflation this year."

-sky news