JPMorgan and Deutsche Bank to face lawsuits accusing them of enabling Jeffrey Epstein's sex trafficking

US district judge Jed Rakoff said the banks must face proposed class action suits by the US Virgin Islands and women who said Epstein sexually abused them.

JPMorgan and Deutsche Bank must face lawsuits accusing them of enabling Jeffrey Epstein's sex trafficking, a US judge has said.

Jed Rakoff, a district judge in Manhattan, ruled the banks must face proposed class action suits by women who said Epstein sexually abused them, saying he would explain his reasoning at a later stage.

The judge also ruled JPMorgan must face a lawsuit by the US Virgin Islands accusing the bank of missing red flags about Epstein's abuse on Little St James, a private island he owned there.

The decision could expose the banks to financial and reputational damage for keeping Epstein as a client after the deceased financier registered as a sex offender.

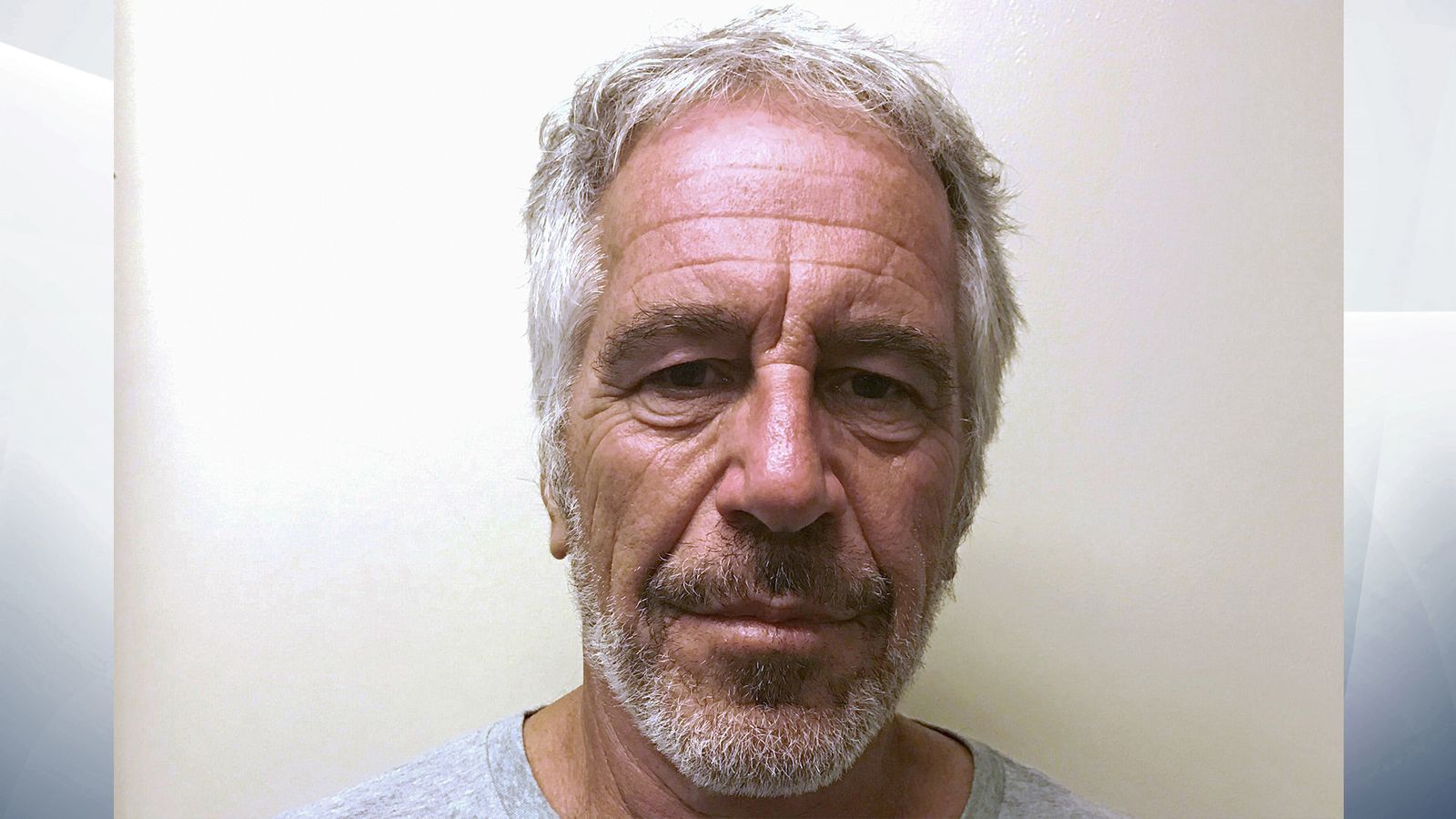

Epstein killed himself aged 66 in a Manhattan jail cell in August 2019 while awaiting trial for sex trafficking. He had pleaded guilty to a Florida state prostitution charge in 2008 and later registered as a sex offender.

'Complicity of banks helped Epstein's abuses'

Brad Edwards, a lawyer for the women, said damages in a scheduled October trial involving more than 300 Epstein victims could total billions of dollars.

"It's a landmark decision," Mr Edwards said. "To my knowledge, it's the first time a class of victims can pursue sex trafficking cases against two major financial institutions.

"Complicity of the banks was a necessary ingredient of Epstein's abuses, and this provides a final layer of accountability."

JPMorgan and Deutsche Bank have said they had no legal duty to protect women from Epstein and denied accusations they knew about his abuses.

Epstein was a client of JPMorgan from 2000 to 2013, and Deutsche Bank from 2013 to 2018.

The acting attorney general of the US Virgin Islands, Carol Thomas-Jacobs, said her office's case would help ensure banks act as "a first line of defence in identifying and reporting potential human trafficking, as the law expects".

The US Virgin Islands previously recovered more than £85.6m ($105m) from Epstein's estate in a settlement in November, while 138 Epstein accusers were awarded more than £98.7m ($121m) from a compensation fund in 2021, also funded by the estate.

The decision comes as JPMorgan's former private banking chief Jes Staley was accused of swapping sexually suggestive messages about young women with Epstein and committing sexual assault himself.

Mr Staley admitted having been friendly with Epstein but expressed regret for the relationship - and denied knowing about Epstein's alleged crimes.

He became chief executive of Barclays Plc after leaving JPMorgan, but resigned in November 2021 amid regulatory concerns about his relationship with Epstein.

-sky news