Leap in numbers seeking debt breathing space - as corporate insolvencies hit highest since 2009

Official figures show more people are using a mechanism to secure legal protections from creditors and how the end of COVID aid is hurting businesses in the tough economy.

There has been a surge in the number of people seeking breathing space from their debts while corporate insolvencies are running at levels not seen for 13 years, according to official figures.

The Insolvency Service data covering England and Wales during the second quarter of the year showed 6,342 companies were registered as insolvent in the three months to the end of June, 13% more than a year earlier.

The body said it was the highest number since the second quarter of 2009.

The number of creditors' voluntary liquidations (CVLs), a process by which directors of a company can voluntarily close down an insolvent business, stood at 5,240 - the highest figure for a quarter since records began.

The data reflects growing concerns on the impact of cost of living and cost of doing business challenges that have gripped the country since the end of the COVID pandemic and its resulting taxpayer aid to support workers and firms.

Bank of England action to bring down inflation, exacerbated by Russia's war in Ukraine, through interest rate hikes since December 2021 have added the squeeze on both households and businesses as borrowing costs have surged.

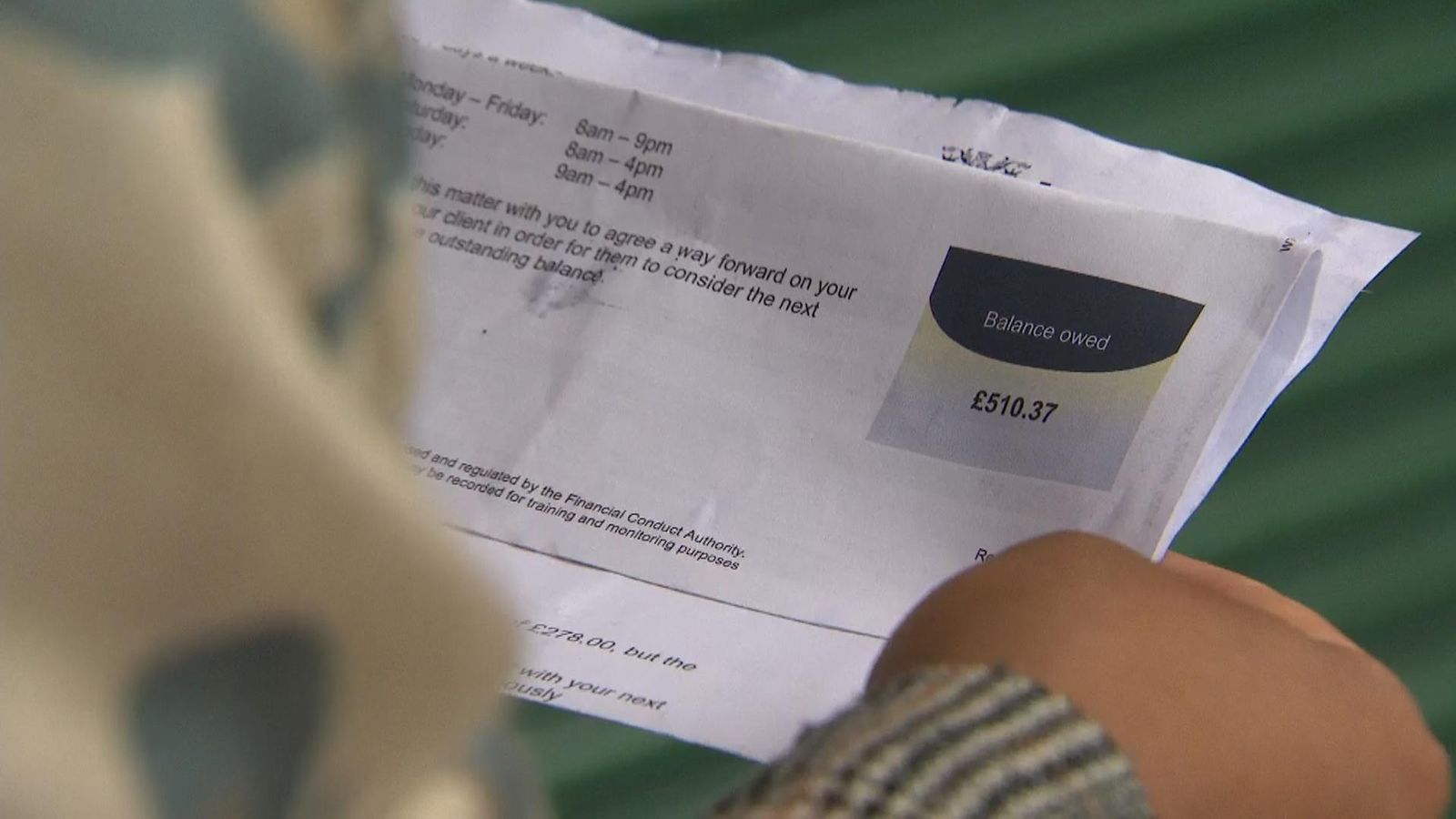

The Insolvency Service data showed that the number of people registering for "breathing space" from their debts jumped by 26% over the three months to the end of June compared to the same period last year.

Activist fund Sparta builds stake in Dr Martens after share price slump

The total hit 21,232, with 313 of those applications coming from people with mental health problems who secure greater protections as they can be shielded from their debt problems for the duration of their treatment.

A standard breathing space to help people with problem debt gives legal protections for up to 60 days.

The number of personal insolvencies was down, the organisation said.

Lindsey Cooper, partner at RSM UK Restructuring Advisory, said of the corporate insolvency figures: "The large rise in total insolvencies is not surprising as 83% of them relate to small businesses entering into a liquidation process where directors of these companies have decided that they have exhausted all recovery options and have no alternative but to cease trading.

"Many of these businesses have high levels of debt on their balance sheets and little or no reserves. They have managed to hold on up until now with the help of the COVID support measures."

She added: 'With the rise in interest rates and hikes in inflation, businesses that previously benefitted from cheap loans and ran on very small margins are now facing significant challenges especially when it comes to renewing bank facilities or refinancing.

"We expect the number of liquidations to continue to increase in the short term."

-sky news