TikToker went viral for explaining why Americans making less than $25/hour 'should be terrified'. Here's how to prove him wrong

As if we don’t have enough to worry about. A recession looks more and more likely, lasting through most of 2023. Inflation remains high, along with interest rates, and more and more Americans continue to find themselves in dire financial straits.

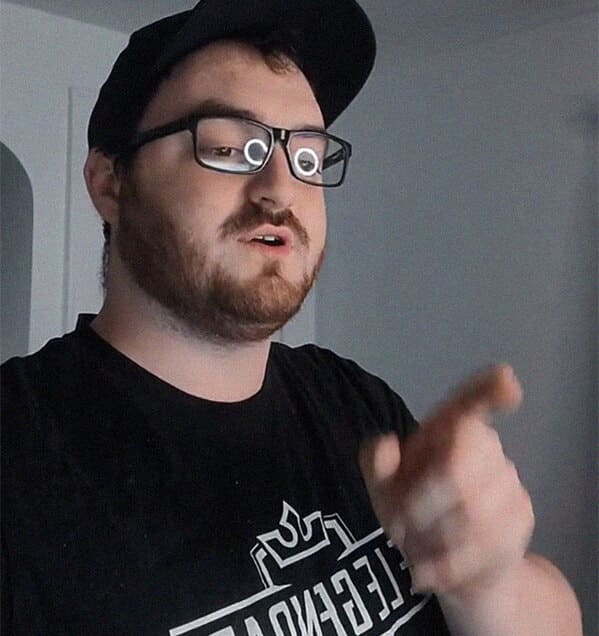

But according to financial TikTok influencer Ryan Halbert, it’s only going to get much worse. If you’re making less than $25 an hour, in fact, he says “you should be terrified.”

In a video that quickly went viral, Halbert broke down the average cost of living in America. And it certainly is terrifying. After putting together all the typical essentials, like rent, groceries, gas and water, the total average cost came to $3,285.37 per month.

Broken down to a 40-hour work week, that means you need to be making at minimum $20.50 per hour.

However, what’s not included here is tax, which Halbert goes on to explain and show in a spreadsheet. Add on tax, and you’d need to make $25 an hour just to squeak into that $3,285 range, after tax comes off your paycheck.

“So this gives you very limited options,” Halbert says.

“You either have to kill yourself working way, way too many hours, or you’ve gotta figure out a way to make a ton of money. And also keep in mind these expenses are factoring in doing nothing. No free time, no going out to eat, no extra miles on the car, nothing.”

Experts don’t agree on how to handle it

Halbert’s video sparked an important discussion among viewers, who quickly shared the video, which now has more than 1.4 million views. Halbert discusses some of the responses, like making cuts to try and keep your costs in check. This might include your streaming services, cable, internet, cellphone and other expensive recurring costs.

But Halbert goes on to say this isn’t a real solution. And he adds you’ll only ever be able to put an extra $200 or so in your pocket, adding “that will never increase, so you have to increase your income. It’s a must.”

This crisis only seems to be getting worse, according to the U.S. Bureau of Labor Statistics. Current employment statistics for November 2022 showed that real average hourly earnings fell 1.9% from November 2021.

Halbert suggests working side hustles isn’t going to create enough income, especially if you want to retire someday. Instead, it’s going to be investing — he says that’s the only way.

But if you ask the experts behind the YouTube channel The Ramsey Show, it’s certainly not the only way.

“This is absolute nonsense,” Ken Coleman, a career coach with The Ramsey Show, commented in reference to the monthly costs presented in the TikTok video.

Coleman, accompanied by George Kamel, The Ramsey Show co-host, admitted that while they realize many Americans feel this way, it’s simply inaccurate. They specifically pointed out that the average used car payment was closer to $700, but also that the average rent would be near $1,659 only in higher-cost cities.

This path doesn’t have to be permanent

They did grant Halbert some points, including that Americans continue to hand over their “hard-earned cash” to lenders.

“They think, ‘Well, this is the path, this is how I get financial freedom, this is what success looks like.’ But we teach no debt. Pay for things with cash, get reasonable used cars. So this is a big part of the picture of why there’s no margin in this person’s budget,” said George Kamel.

But where the pair really had an issue was that the only solution was to “kill yourself working,” or accept this fate. That’s because what Halbert doesn’t cover in his videos are real solutions to cost savings. For example, the pair feel you shouldn’t be paying $1,659 in rent as a single person.

Instead, they suggest you find at least one roommate to cut costs in half. Or sell that car you can’t afford, Kamel suggested.

In the end, Coleman says that usually these are simply periods in your life that you need to get through on your path to financial freedom.

“This isn’t a sentence. This is a season of your life, but it’s not a life sentence.”

Make some breathing room in your monthly budget

It's always worthwhile to cut down on your monthly bills as much as you can — no matter how much you make.

Unfortunately, your mortgage payments and utility bills are non-negotiable. But there is one bill you can do something about: Home insurance.

Case in point: Local homeowners in Washington state often save close to $1,000 or more per year by shopping around for their insurance — according to nonprofit consumer group Puget Sound Consumers’ Checkbook.

Normally, shopping around for insurance quotes takes forever and it's a hassle to field multiple phone calls from different insurance agents. But now you can easily find better rates online, and it only takes three minutes* with SmartFinancial.

The average price of a home insurance policy in 2022 was $1,680 — nearly 40% higher than it was 12 years ago. Rates are expected to keep rising in 2023 so the time to act is now* to make sure you are getting the best price possible your policy.

-US weekly