'Rachel Reeves would hate' former minister's tax plea - as small boat crossings hit record

The number of illegal migrants crossing the Channel in small boats this year has sailed past 25,000 in record time. Meanwhile, an ex-Labour minister joins calls for Rachel Reeves to consider a wealth tax.

What are the options for a wealth tax?

Wealth taxes have become a calling card for MPs on Labour's left, who think the chancellor should target the richest in society to raise money rather than cutting budgets.

On the show tonight is Dame Louise Ellman, former chair of the group Labour Friends of Israel.

Also joining us is Zelda Perkins, a former assistant to the disgraced Hollywood film mogul Harvey Weinstein, who broke her own nondisclosure agreement to expose his predatory behaviour.

She'll be speaking about the UK government's pledge to ban NDAs designed to silence staff who've suffered harassment or discrimination.

What is a wealth tax and how could it work?

The idea of a wealth tax has become a national talking point as the government attempts to balance its books.

What is a wealth tax?

A wealth tax is aimed at reducing economic inequality to redistribute wealth and to raise revenue.

It is a direct levy on all, or most of, an individual's, household's or business's total net wealth - including their savings, investments, property and other forms of wealth, minus a person's debts.

Unlike capital gains tax, which is paid when an asset is sold at a profit, a wealth tax is normally an annual charge based on the value of assets owned, even if they are not sold.

Or a one-off wealth tax, often used after major crises, could raise a substantial amount of revenue in one go.

How could it work in the UK?

Advocates of a wealth tax, including former Labour leader Lord Kinnock, have proposed an annual 2% tax on wealth above £10m.

Wealth tax campaign group Tax Justice UK has calculated this would affect about 20,000 people - fewer than 0.04% of the population - and raise around £24bn a year.

The group proposes people self-declare asset values, backed up by a compliance team at HMRC who could have a register of assets.

Which countries have or have had a wealth tax?

In 1990, 12 OECD (Organisation for Economic Co-operation and Development) countries had a net wealth tax, but just four have one now: Colombia, Norway, Spain, and Switzerland.

France and Italy levy wealth taxes on selected assets.

Colombia

Since 2023, residents in the South American country are subject to tax on their worldwide wealth, but can exclude the value of their household up to 509m pesos (£92,500).

The tax is progressive, ranging from a 0.5% rate to 1.5% for the most wealthy until next year, then 1% for the wealthiest from 2027.

Norway

There is a 0.525% municipal wealth tax for those with net wealth above 1.7m kroner (about £125,000) or 3.52m kroner (£256,000) for spouses.

There's also a state wealth tax of 0.475% based on assets exceeding a net capital tax basis of 1.7m kroner (£125,000) or 3.52m kroner (£256,000) for spouses, and 0.575% for net wealth above 20.7m kroner (£1.5m).

The maximum combined wealth tax rate is 1.1%.

Spain

Residents in Spain have to pay a progressive wealth tax on worldwide assets, with a €700,000 (£600,000) tax-free allowance per person in most areas and homes up to €300,000 (£250,000) tax-exempt.

The rate goes from 0.2% for taxable income for assets of €167,129 (£144,000) up to 3.5% for taxable income of €10.6m (£9.146m) and up.

Switzerland

All the country's cantons (districts) have a net wealth tax based on a person's taxable net worth - different to total net worth.

It takes into account the balance of an individual's worldwide gross assets, including bank account balances, bonds, shares, life insurances, cars, boats, properties, paintings, jewellery - minus debts.

Switzerland also works on a progressive rate, ranging from 0.3% to 0.5%, with a relatively low starting point at which people are taxed.

Ex-Labour minister 'hopes' Reeves is considering wealth tax

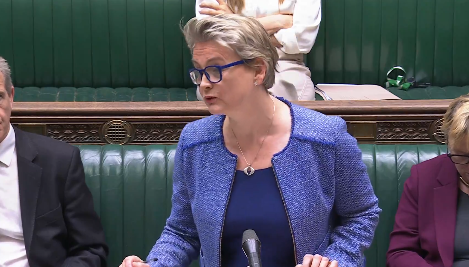

A former Labour minister has said she wants Rachel Reeves to consider the "evidence" behind introducing a wealth tax in the UK.

Speaking to our political editor Beth Rigby on Electoral Dysfunction, Anneliese Dodds, who quit as international development minister over Keir Starmer's decision to slash the aid budget, said she believed it was "important" the government considers "who has the broadest shoulders".

Watch the exchange below, as Beth tells her: "If Rachel Reeves was listening to this podcast, she'd absolutely hate what you just said."

Dodds was Sir Keir Starmer's first shadow chancellor when he became Labour leader in 2020, before Reeves replaced her in 2021.

She quit her ministerial role after less than a year in government.

Tories bid farewell to 'grandfather of Brexit'

It wasn't so much a gathering of the Thatcher clan, because there are not many of her cabinet ministers from the 1980s still around these days.

But the majority of the Tory grandees who gathered at St Edmundsbury Cathedral in Suffolk for the funeral of her most loyal ally Norman Tebbit were indeed Thatcher devotees.

Paying tribute to the politician known as "the first Brexiteer" and "the grandfather of Brexit" were Jacob Rees-Mogg, Mark Francois, former 1922 Committee chairman Lord Graham Brady and Liz Truss's deputy PM Therese Coffey.

From the Thatcher years were novelist and Tory cheerleader Jeffrey Archer with his wife Mary, John Gummer, who was Tory chairman in the mid 80s, and the husband and wife political duo Neil and Christine Hamilton.

But there was no sign of Lord Tebbit's old foes over Europe, such as Thatcher cabinet big beasts Michael Heseltine or Kenneth Clarke, or Tory leaders with whom he clashed over Europe, such as John Major and David Cameron.

Typically, given Tebbit's robustly held uncompromising beliefs and values, his funeral was a service that was traditional and patriotic. Lady Thatcher would definitely have approved.

It began with Elgar's stirring Nimrod from the Enigma Variations and the hymns included the cup final anthem Abide with Me and I Vow to Thee, My Country, to the music from Holst's The Planets.

Tebbit's successor as MP for Chingford, Sir Iain Duncan Smith, who attended with his wife Betsy, gave the first reading, the scene from Shakespeare's Hamlet in which Laertes says goodbye to his sister Ophelia.

When he left the Commons in 1992, Tebbit famously said of his successor, who went on to become Tory leader from 2001 to 2003: "If you think I'm right wing, you should meet this guy."

One of Thatcher's favourite business tycoons, the former P&O boss and major Tory donor Lord Jeffrey Sterling, read The Lord's My Shepherd, before Tebbit's children, William, Alison and John, shared some family reflections.

The eulogy was delivered by Lord Michael Dobbs, best known as the author of the 1990s TV political blockbuster House Of Cards, but before then an influential Tory insider, working for both Thatcher and Tebbit.

He worked for Thatcher when she was opposition leader from 1975-79 and was a special adviser to Tebbit at the departments of employment and then trade and trade and industry and his chief of staff when he was Tory chairman.

'An inspiring leader'

The service ended with references to Tebbit's early life in the RAF, before he became a commercial pilot, with the Last Post played by an RAF Central Band trumpeter and then the official RAF March.

After the service Dobbs described Tebbit as "a giant, an inspiring leader", while Archer said he was "above all loyal", adding: "Loyalty was his passion."

Duncan Smith said Tebbit was his mentor throughout the early part of his political career and said: "He was a tough competitor, but the beauty of it that came out was he had a real soft heart and was kind and had many friends on all sides of the House."

The funeral was followed by a private cremation and friends have told Sky News a memorial service for Tebbit will be held in due course.

Breaking down small boat numbers

After 898 people crossed the Channel in small boats yesterday, the total has surpassed 25,000 for 2025.

That's the earliest point in a calendar year at which that threshold has been crossed since records began in 2018.

Some other statistics for you, based on analysis by PA news agency:

- It's up 51% on this point last year (16,842)

- It's 73% higher than at this stage in 2023 (14,732)

The average number of people per boat this year is 59 - on some days it's been upwards of 75

Last year the 25,000 figure was crossed on 22 September, and the year before it was 2 October

Politics At Sam And Anne's: Will Rachel Reeves's sums ever add up?

It is arguably the number one issue facing the government - how do they get the economy thriving and growing again.

Sam and Anne are joined by our economics and data editor Ed Conway to weigh up the options on the table for Rachel Reeves.

Ahead of a crucial budget in the autumn, the trio address:

How will the chancellor fill the black hole in the public finances?

Are tax changes on the horizon?

Will there be more nationalisation?

Plus, there is still some time to predict if Rachel Reeves will remain in Number 11 Downing Street, after a tumultuous year in office.

Sam and Anne are getting a lie-in over summer recess, but they'll be in your feed with special episodes every Monday before normal services resumes on 1 September.

-SKY NEWS