1923: How Weimar combatted hyperinflation

100 years ago, prices in Germany were soaring by 50% each month, a loaf of bread cost millions of mark. How did the young republic rein in inflation?

From 1921 to 1923, the Weimar Republic suffered one of the greatest economic crises in German history: hyperinflation. During the "Golden Twenties" the German mark rapidly lost nearly all of its value, inflation turning into hyperinflation until a pound of butter cost millions of marks.

There were multiple reasons for this hyperinflation: The Weimar economy was still suffering from the effects of World War I, when the German government had printed more and more money to pay for the ever-escalating costs of the war, thus significantly devaluing the mark. The economy was put under further strain by the reparations demanded of the young Weimar republic in the Peace Treaty of Versailles.

Above all, however, the Weimar government shot itself in the foot, as economist Jutta Hoffritz explains to DW.

When the young republic was lagging behind with its reparations payments, French and Belgian troops occupied the Ruhr Valley to secure the rich coal mines in the region. The local population went on strike to resist the occupation, and the government in Berlin fired up the money printing presses so that it could keep paying the "patriotic" strikers their wages.

When 'patriotism' leads to an economic crisis

With this "patriotic measure," the government fueled the depreciation of its own currency, Hoffritz says. The economist published the book "Totenanz — Das Jahr 1923 und seine Folgen" ("Dance of the Dead — The Year 1923 and Its Aftermath") this year in German, in which she explores the causes of hyperinflation in the Weimar Republic 100 years ago.

"Germany cut back on their most important line of production just because they didn't want the French to have any of their coal and steel. Instead, they said, okay, then we won't produce anything at all."

When the central bank began printing money to aliment the strikers, prices rose. "Inflation and a loose monetary policy go hand in hand," Jutta Hoffritz explains. When there is a lot of money in circulation but little commodity,the value of money falls.

Hyperinflation had a devastating impact on the lives of people in Germany. Prices rose rapidly; just one loaf of bread soon cost millions of marks. In her book, Hoffritz describes how in 1923, the famous German artist Käthe Kollwitz began to store potatoes in the guestroom she and her husband had sublet to a tenant. Only a narrow path remained from the door to the bed, showing just how desperate everyone was to hold onto what little food they could get.

A currency reform saved the day

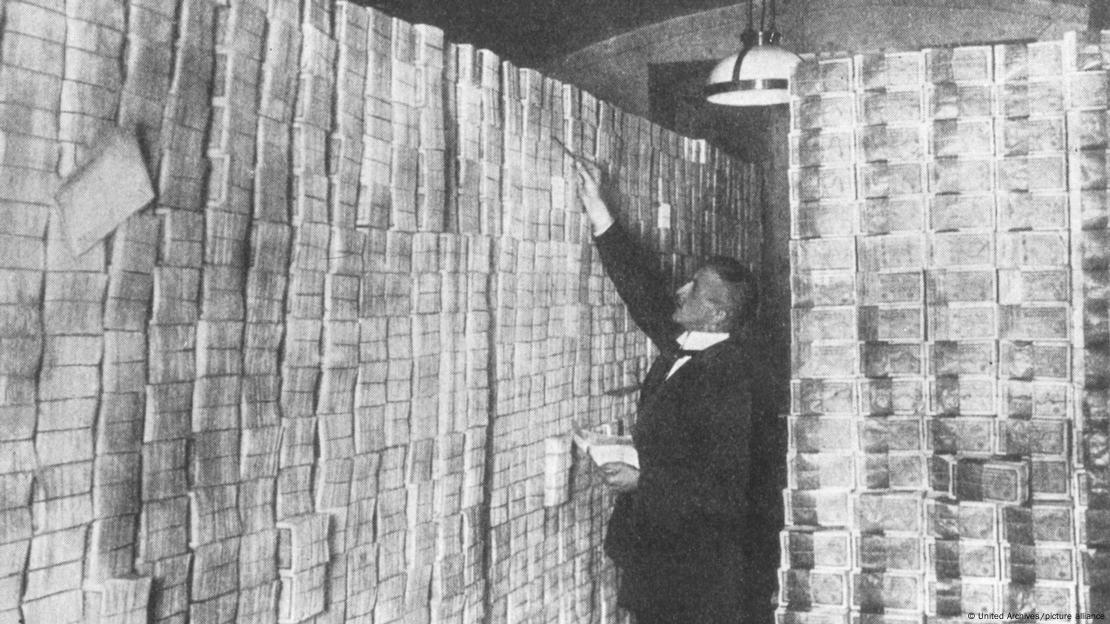

To cope with the situation, the Reichsbank issued more and more bills, driving inflation even further. "The Reichsdruckerei employed three times as many people in 1923 than before the war, and almost all of Germany's other printing companies were in the service of the Reichsbank so that it could print all that money," Hoffritz explains. "Almost the entire paper-processing manufacturing industry was busy printing new bills."

It took a new Reichsbank president to combat inflation. He stopped printing money and introduced a new currency, the "Roggenmark" ("rye mark"). As an alternative currency, Jutta Hoffritz explains, the rye mark was intended to regain the confidence of the population and was partly backed by German farmers and agricultural landowners. The currency's value was based on how much rye a specific portion of agricultural land could yield.

Hoffritz calls this "a magic trick." After all, no one in Germany could have gone to the bank with their rye mark and exchanged their bank notes for land. But since no one tried to, the illusion remained intact. The currency remained stable and was accepted as a means of payment as prices fell.

What about inflation in the present?

Today, the situation is different, Hoffritz tells DW. There are a few analogies, of course: "High inflation or even hyperinflation often has something to do with a war," she says, referring to the Russian war of aggression against Ukraine. European countries are not involved with soldiers on the ground, but their gas supply has been cut, and gas is as important a resource for the economy and the consumer today as coal was in 1923.

In addition, the European Central Bank has also been pursuing a loose monetary policy for years. These are favorable conditions for inflation, Hoffritz says.

"But that's where the parallels end," the economist affirms. "We are talking about high inflation today, higher than in my entire lifetime: 10%. That's a lot, but in 1923 we're talking about hyperinflation. That's a whole different ballpark."

1923 saw prices rise by 50 % - a month

Currently, prices are increasing in many European countries by around 10% compared to the same month last year. That means that bread in December 2022 is 10% more expensive than in December 2021.

In hyperinflation, prices increase by 50% every month, so bread in December 2022 would be 50% more expensive than in November 2022.

"So what we're talking about right now is high inflation. That's a cause for concern," Hoffritz says, "and it's also higher than what I have ever experienced. But it's not hyperinflation."

Some of her readers have been approaching the current inflation with a sense of humor. One of them sent her an old bill from the Weimar Republic. "I get a lot of stories from people who, as children, found a pack of bills in the attic and felt totally rich for five minutes. It's like, 'I've found Grandpa's hidden treasure!'"

To their disappointment, Hoffritz reports, her readers were quickly disillusioned: "Then grandma comes in and says, yes, that's what's left over from 1923. And back then we couldn't even buy a buttered bread roll with it."